Physician Hiring Decision Intelligence

For smarter hiring decisions

Fewer wasted interviews and fewer surprises later. Tessellate helps hiring teams understand how physicians evaluate roles by turning market insight into measurable hiring decisions.

Not a job board or recruiting agency.

What Tessellate is

Tessellate is a Physician Decision Intelligence platform for hiring teams.

Job boards and agencies focus on transactions. Tessellate provides market intelligence, benchmarking, and workflow insight that helps organizations understand how physicians evaluate their opportunities.

Unit Truth

Verified clinical reality

Clinical scope (de-identified claims): procedures, volumes, acuity/complexity

Working conditions (verified): call/coverage, autonomy, workflow load, staffing reliability

Confidence tags: Verified / Inferred / Unknown

Consent-gated intros

No spam. No cold databases.

Physician-controlled identity: private until they request an intro

Fast Pass packet: verified must-haves + fit reasons + gaps to verify

Less chase work: fewer dead-end screens, higher show-rates

Outcome measurement

Hiring insight that gets sharper with use

Funnel analytics + benchmarks: interest → apply → interview → hire

“Why‑fit / why‑not” signals: captured early to tune roles + units

Retention learning: models improve as outcomes accumulate

Physicians control identity + sharing. Employers only see aggregated unit insights until a physician opts into an intro.

How hiring decisions become clearer

Step 1

Anonymous alignment

Physicians explore fit privately, without pressure or exposure.

Step 2

Questions answered

(still anonymous)

Role-specific realities are clarified early so expectations match reality on both sides.

Step 3

Consent to connect

Only physicians who see a clear fit opt in to introductions - filtering out late-stage drop-off.

Step 4

Fast Pass introduction

Hiring teams receive decision-ready context, not raw interest.

Built for in-house teams and leader-led hiring

We have a recruiting team

(Press the switch)

We don’t have a recruiting team

(Press the switch)

With in‑house recruiters

(Co‑pilot mode)

Physician‑approved intros that meet your requirements—qualified, interested, ready to interview.

We pre‑fill forms; recruiters review & attest—less rework.

One thread through email (ATS APIs coming); higher show‑rates.

Signal reporting: early “why not” so reqs can be tuned

No in‑house recruiters

(Full‑service mode)

We act as your on‑call recruiting desk—no ATS required.

You define the role once (12‑min unit survey); we run the search.

We assemble documents, coordinate interviews, and keep everyone updated.

You decide only on who to meet and who to hire.

Works with or without an ATS

HIPAA‑aligned; zero PHI required

No placement fees

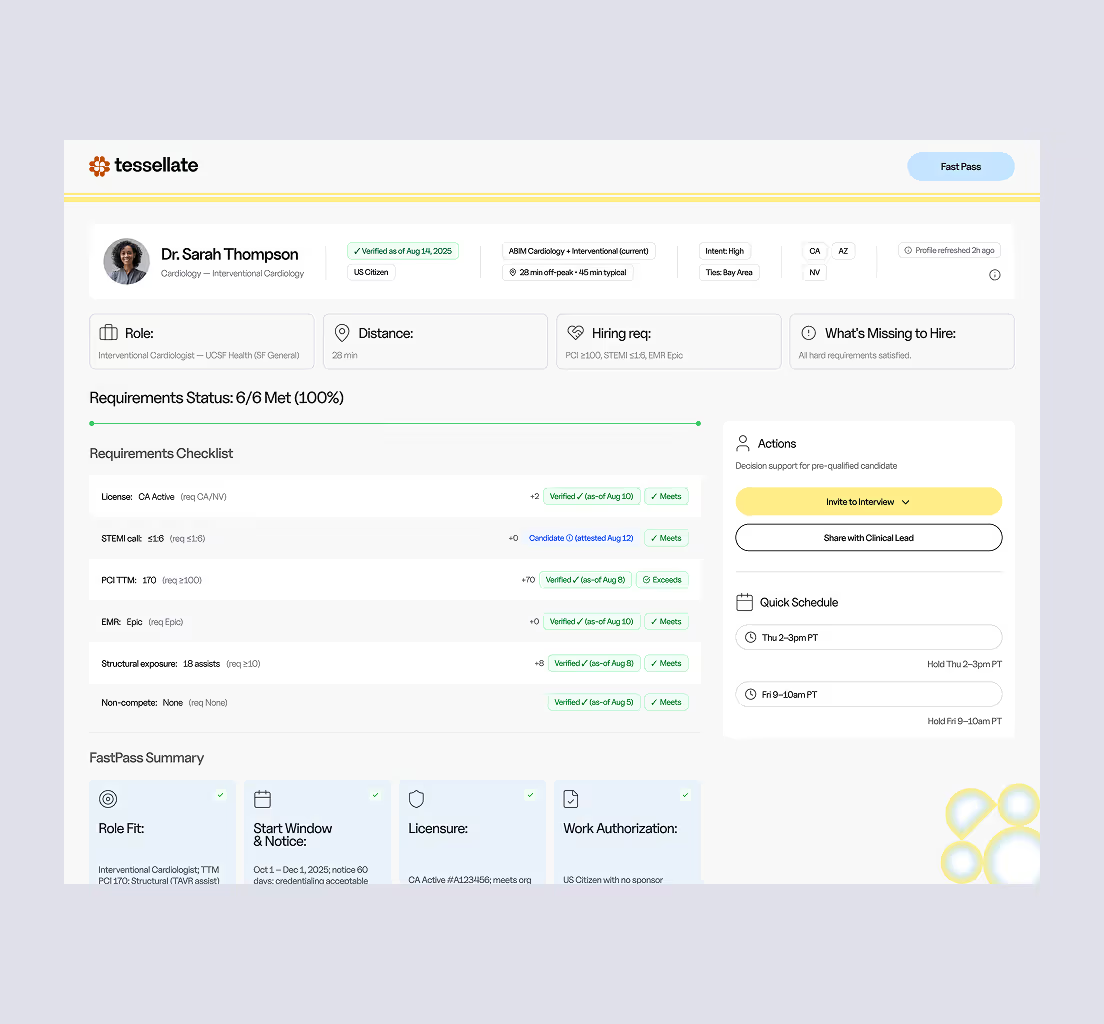

Your fast pass packet

Fast Pass introductions start with decision clarity

A standardized, decision-ready view so first conversations are productive.

Standardized application

Fully pre-filled from physician intake; exportable fields.

Fit reasons

Top “why this matches” mapped to Clinical / Lifestyle / Financial / Location.

Physician attestation

Candidate affirms accuracy before the intro.

Scheduling windows

Two or three time options; we coordinate calendars and send ICS invites.

Gaps to verify

The 2-3 items that merit discussion early.

Credentials

Licenses, DEA/CSR, board cert, NPI, CV

Signal trail

What the physician is solving for; reasons for “yes/no”; follow-ups.

Less chasing, more interviewing

Today’s reality

Repeated re-screening

Key questions answered late

Fragmented information

Scheduling friction

Consent-based intro

You start with interest confirmed.

Packet-complete

Fewer form gaps and rescreens.

Scheduling relay

Interviews confirmed faster, with higher show-rates.

Signal reporting

“Why not” is captured early so reqs can be tuned.

Insights & benchmarks

Powered by physician signals and medical leaders

We show what physicians are solving for—and how your roles stack up—using preference data across up to 130 criteria and anonymized inputs from clinical leaders. Use the benchmarks now, and add your realities to sharpen them.

What you get

Acceptance drivers (by specialty & setting)

What moves physicians to interview and accept: schedule/call mix, comp ranges, autonomy, team makeup, location constraints.

Funnel & speed

Time‑to‑first‑interview, interview→offer conversion, most common decline reasons.

Competitive position (aggregate)

Where your offer lands relative to market expectations—without naming organizations.

Signal trail

The “why” behind physician yes/no so you can tune reqs early.

Contribute: medical leader survey

Why contribute

Calibrate benchmarks to your reality; shorten rework; help your service line win more acceptances.

What we ask

Care settings, call structure, autonomy, staffing mix, must‑haves/flex.

What you get back

Quarterly aggregates and a brief on your specialty/market.

Cross-specialty

(National)

Interview speed wins: +31% acceptance when the first interview ≤ 7 days.

Why: Momentum reduces parallel shopping and drop-off.

IM Outpatient

(Southeast)

Role tuning works (call + hybrid).

After moving call 1:4 → 1:5 and adding 1 remote day/week: pipeline +38%, time‑to‑first‑interview –19% within 30 days.

Why: Small, published changes unlock aligned candidates fast.

Emergency Medicine

(Great Lakes region)

Single-coverage nights deter.

Acceptance −26% where single-coverage nights and annual volume >45k; adding float coverage restores +14%.

Why: Safety staffing is a first-order screen.

Hospitalist

(National)

Admit cap is decisive.

+41% approve‑intro rate when admit cap ≤12/day is stated; –23% when cap is >18/day or unstated.

Why: Workload clarity drives early engagement.

Every place physicians practice

If you employ or contract MD/DOs for clinical care

in the U.S., you’re in scope—large or small, public or private. We partner with health systems and independent groups.

Methods: how we count

Independent medical groups & private practices

Single‑specialty (e.g., ortho, GI, cardiology, psych, EM, HM, anesthesia, radiology, pathology), multi‑specialty groups, physician‑owned practices, MSO/PE‑backed platforms.

Outpatient & procedural sites

Hospital‑owned clinics, independent clinics, ASCs, urgent care, employer on/near‑site clinics, retail clinics where physicians practice, RHCs.

Health systems & hospitals

Academic medical centers, community hospitals, children’s hospitals, critical access hospitals, specialty institutes.

Community & public

FQHCs/CHCs, county/city clinics, VA/DoD/MTFs, IHS, correctional health.

Telehealth & hybrid groups

Virtual‑first or mixed models where physicians deliver care.

Academic departments with clinical appointments

Faculty practice plans and subspecialty divisions.

FAQ: How Tessellate works

What is Tessellate (and what isn't it)?

Tessellate helps physicians explore new roles privately, intelligently, and without recruiter pressure. Behind the scenes, we look at how physicians actually experience roles day to day – be it scope, autonomy, incentives, or expectations – so that introductions are based on fit, not volume.

Tessellate is not a job board, not a resume database, and not a contingency recruiting firm. There’s no spam, no blind submissions, and no pressure to move before you’re ready.

Every introduction happens only with physician consent, and only when there’s a clear case for mutual fit.

What makes Tessellate different from traditional sources?

Traditional recruiting sources optimize for volume; Tessellate optimizes for decision quality. Instead of pushing roles based on availability or urgency, we surface opportunities based on measurable details about how a role actually functions, so physicians can assess fit before investing time or energy.

How does Tessellate ensure alignment with our needs?

Most matching breaks down because it relies on titles and keywords. Tessellate focuses on how a role actually functions.

By grounding each match in clinical scope, working conditions, and real expectations, we make it easier to see where fit is strong and where it needs validation, so teams spend time on the right conversations.

How does the process work?

Physicians explore roles privately and without pressure. You’re only engaged when interest is mutual.

We then provide a Fast Pass and Unit Snapshot that surface what matters most, so teams can quickly assess fit before investing time.

How quickly will we see matched candidates?

There’s no fixed timeline, but clarity drives speed.

Teams that articulate scope, working conditions, and priorities up front and respond promptly tend to see stronger interest sooner.

Do you replace our recruiters or ATS?

No. Tessellate complements your existing recruiters and systems by reducing clutter and improving decision quality.

Your team remains in full control of interviews and offers, and you can start without any ATS integration.

What if we don’t hire someone through Tessellate right away?

That’s okay. Tessellate is built to improve clarity, not rush decisions.

Even without an immediate hire, teams gain a clearer understanding of how their role is perceived and what may need refinement, leading to better conversations and stronger outcomes over time.

How do you protect our data and physician privacy?

Physicians remain anonymous unless they choose to engage, and recruiter outreach is not permitted.

Employer data is used only to support your hiring efforts, with any broader insights shared in aggregate and without identifying individual teams.